maricopa county irs tax liens

Ad See Anyones Public Records All States. Enter Name Search Risk Free.

Tax Debt Collection Compromise Levy Liens Lawyers Silver Law Plc

The initial step is for the IRS or local tax agency to decide that a person truly owes.

. Find Information On Any Maricopa County Property. Tax liens offer many opportunities for you to earn above average returns on your investment dollars. The Maricopa County Treasurers Tax Lien Web application allows you to monitor your CP Buyer account with Maricopa County.

Watch 4min Video That Explains All. The process of imposing a tax lien on property in Maricopa County Arizona is typically fairly simple. All groups and messages.

View Anyones Arrests Addresses Phone Numbers Aliases Hidden Records More. Ad See If You Qualify For IRS Fresh Start Program. However since the early 1990s.

When a lien is auctioned it is possible for the bidder to achieve that rate too. Ad Big Secret Banks May Not Want Exposed. Fast Easy Access To Millions Of Records.

Tax Liens in Maricopa County AZ Displaying 1 - 10 of 11375 Results 0 Watch List Tax Lien NEW View Details More Foreclosures in Mesa E Arbor Ave 50 Mesa AZ 85206 BEDS BATHS. Tax deeded land sales are conducted by the Maricopa County Treasurers Office on an as-needed basis with Maricopa County acting as the agent for the. The interest rate paid to the county on delinquent taxes is 16.

Tax Lien Certificates Yield Great Returns Possible Home Ownership. 400 W Congress Street Tucson AZ 85701 Online Payment Once a payment has posted online a letter of Notice of Intent to Release State Tax Lien will be provided within 24 hours to the. Maricopa County pays up to 16 for tax lien certificates which are sold via a bid down auction.

Search Any Address 2. Free Case Review Begin Online. The Maricopa County Arizona Treasurers Office requires that buyers submit a list of the property tax lien certificates they intend to purchase along with a cashiers check money order.

Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax. Ad Search Information On Liens Possible Owners Location Estimated Value Comps More. Maricopa County AZ currently has 18139 tax liens available as of August 29.

Check your Arizona tax liens. Tax Deeded Land Sales. The Maricopa County Treasurers Office does not guarantee the positional accuracy of the Assessors parcel boundaries displayed on the map.

See Available Property Records Liens Owner Info More. Ad Need Property Records For Properties In Maricopa County. Ad Need Property Records For Properties In Maricopa County.

Just remember each state has its own bidding process. The Arizona Tax Department was established in September 1988 and has jurisdiction over disputes anywhere in the state that involves the imposition assessment or collection of a tax. Based On Circumstances You May Already Qualify For Tax Relief.

Type Any Name Search Risk-Free. Ad Find Anyones Tax Lien Lists. The Tax Lien Sale will be held on February 9 2021.

95 to 97 of the certificates are redeemed however if you dont get paid you get the property. Find Information On Any Maricopa County Property.

The Essential List Of Tax Lien Certificate States

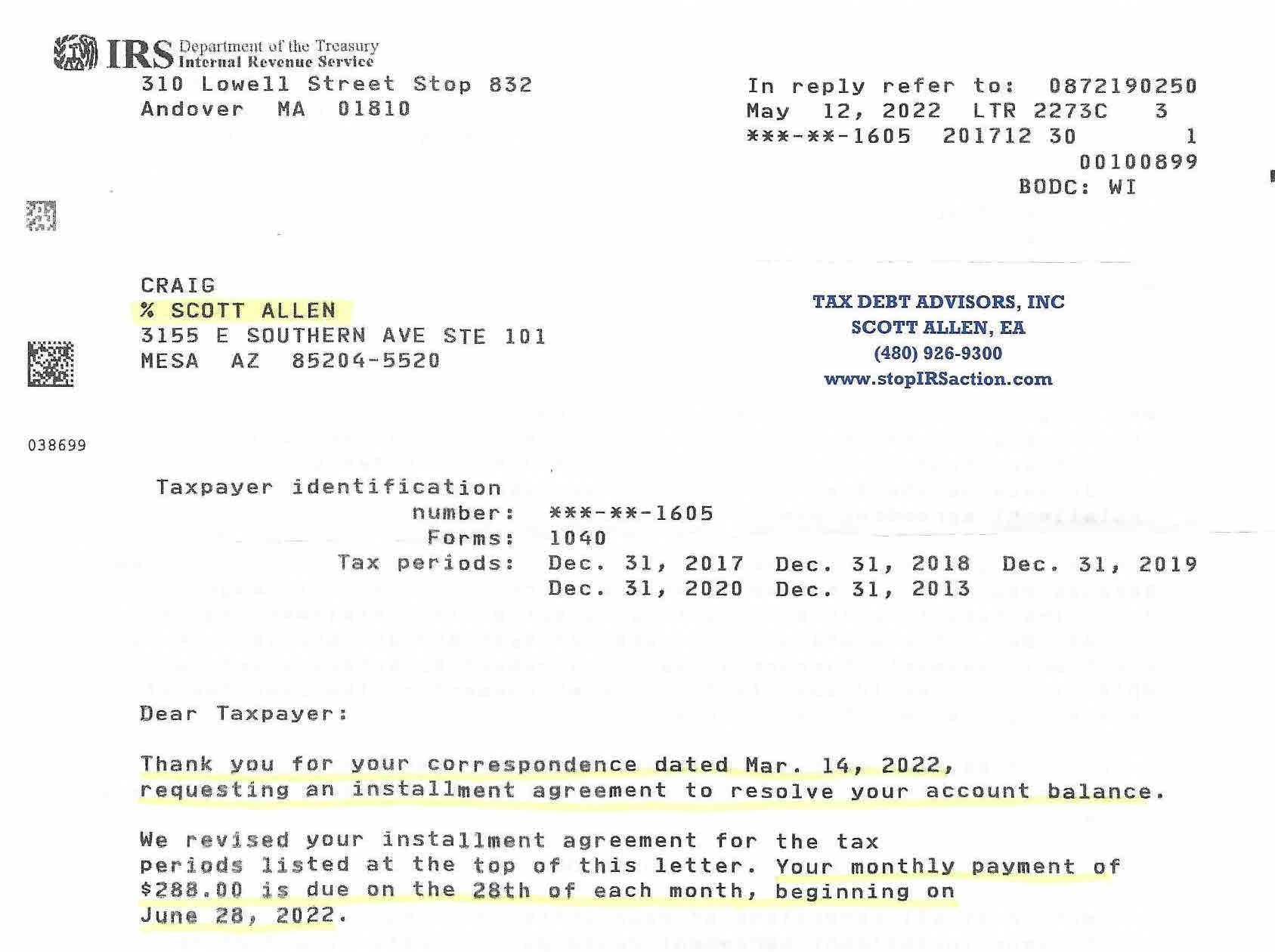

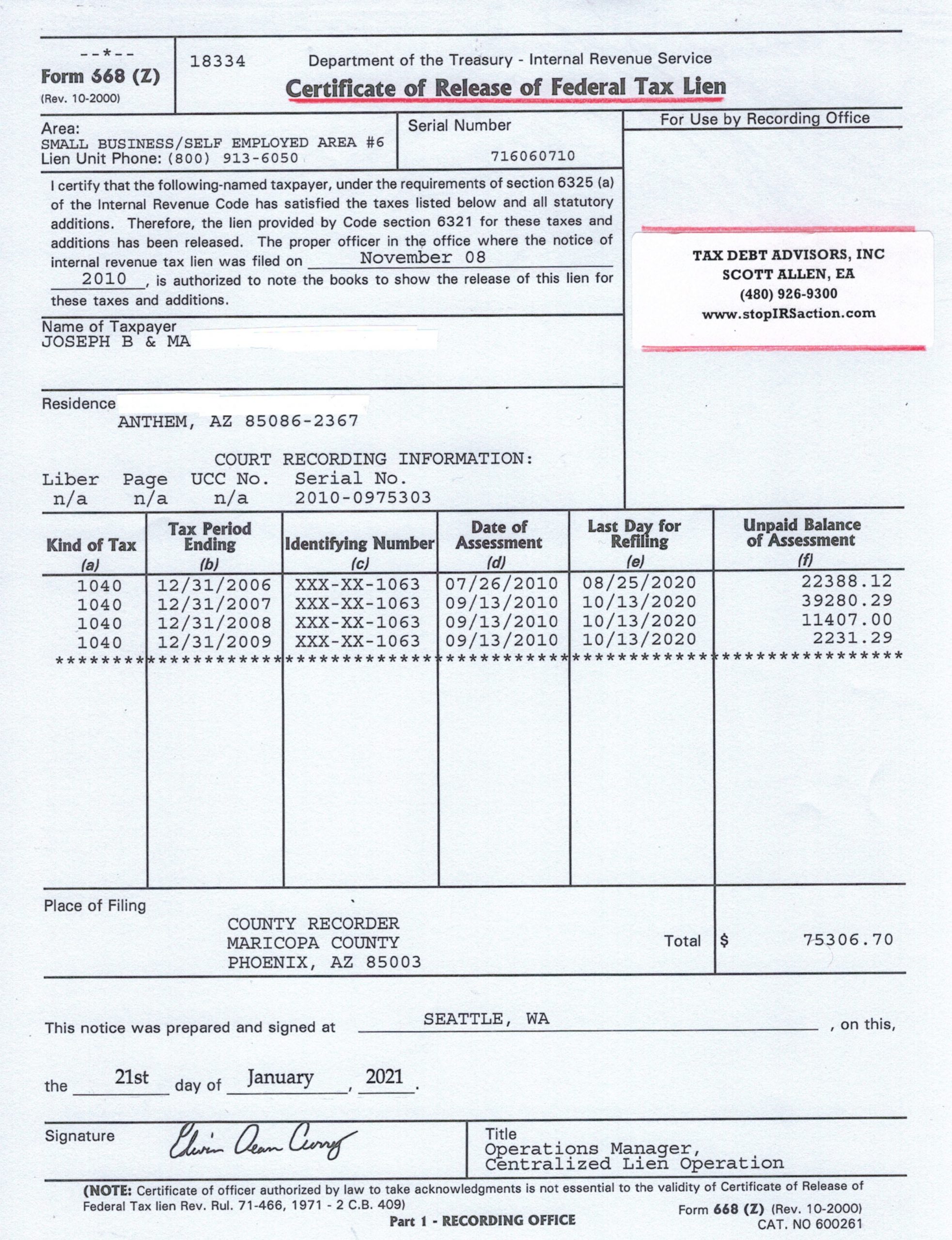

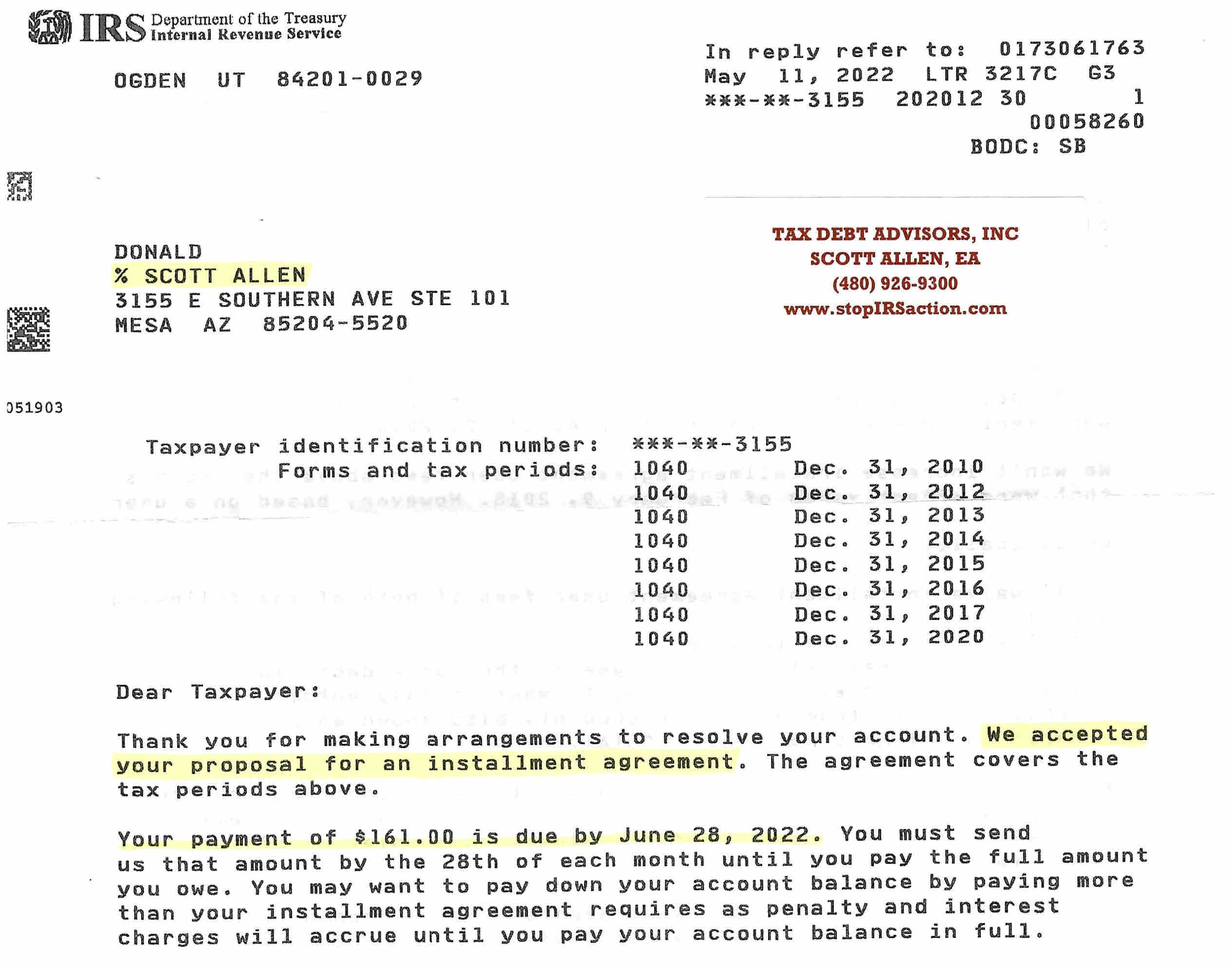

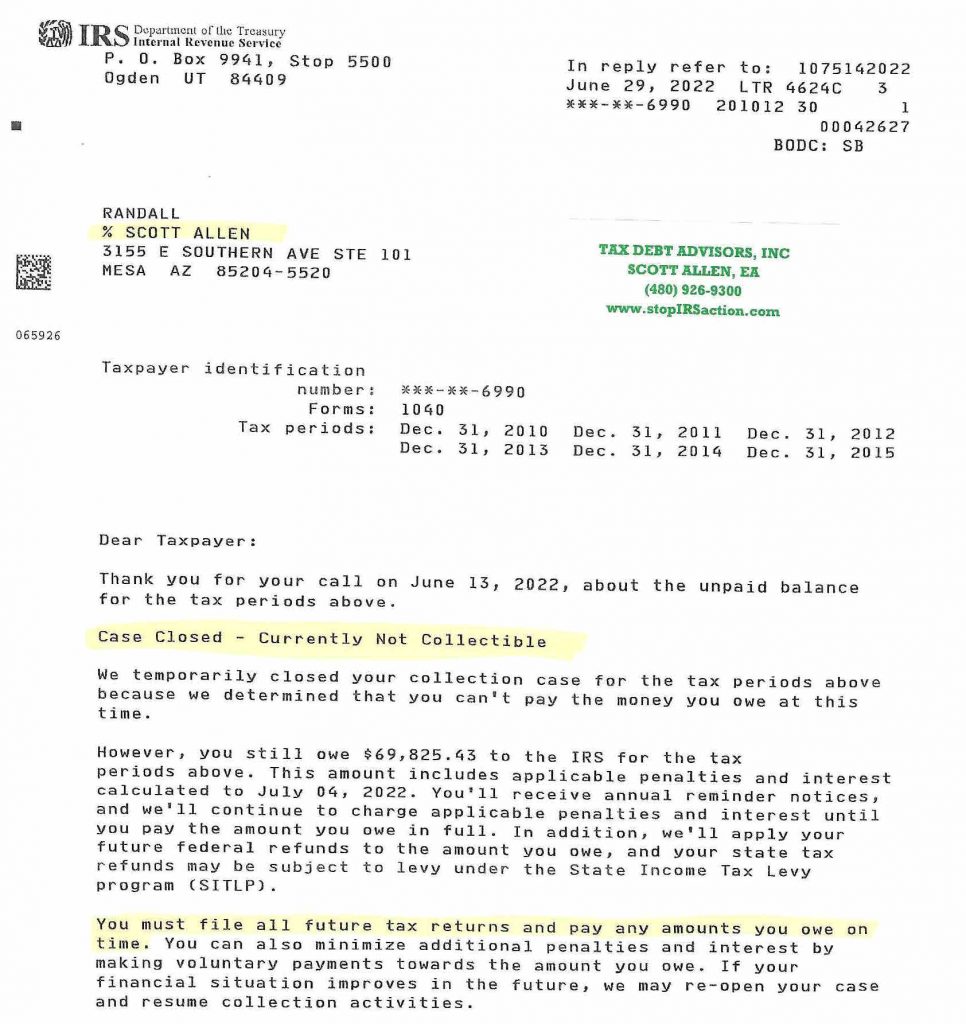

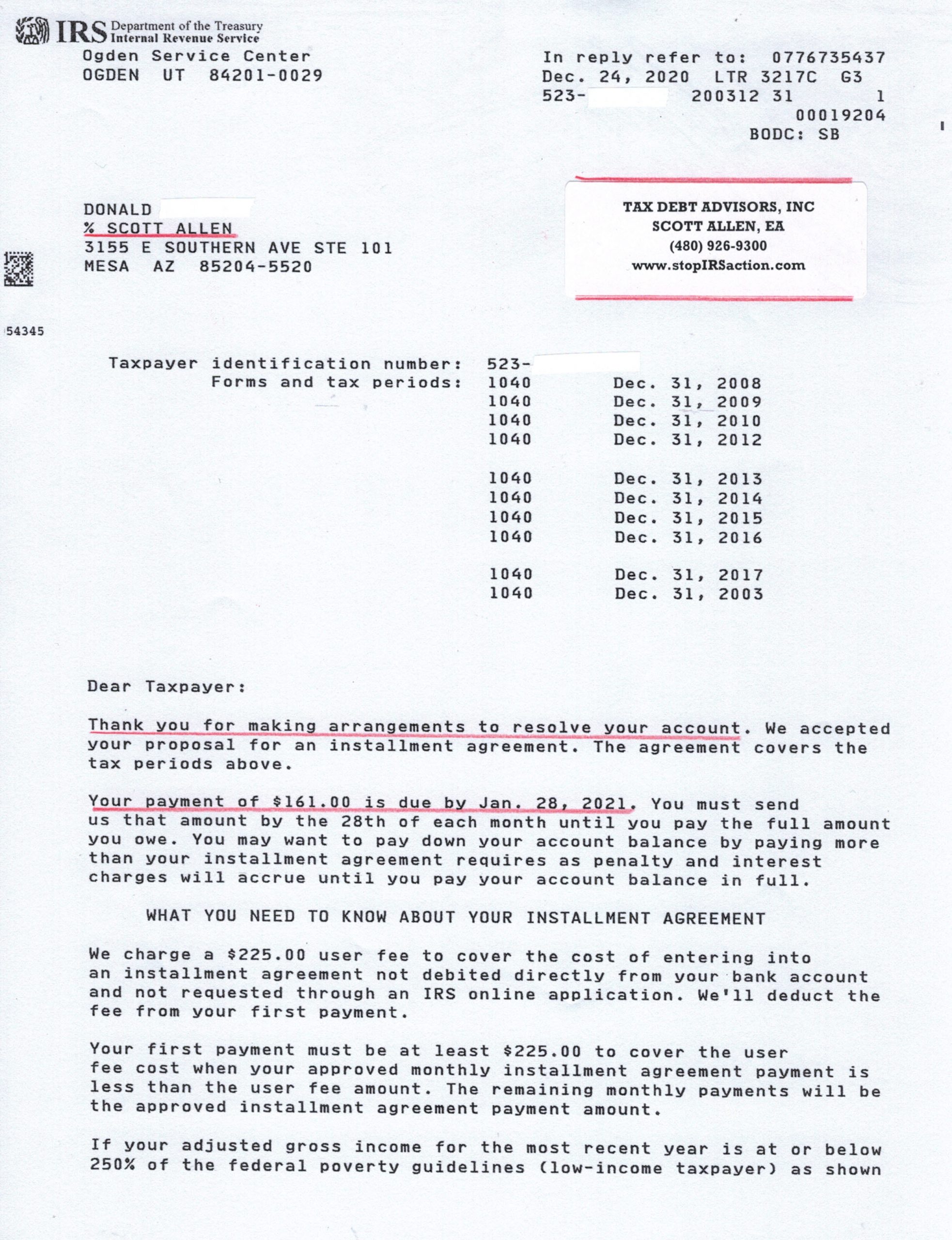

Irs Tax Lien In Arizona Irs Help From Tax Debt Advisors Inc Tax Debt Advisors

The Essential List Of Tax Lien Certificate States

Delinquent Property Tax Lien Sale Overview Arizona School Of Real Estate And Business

Irs Tax Lien Problems Tax Debt Advisors

The Essential List Of Tax Lien Certificate States

The Essential List Of Tax Lien Certificate States

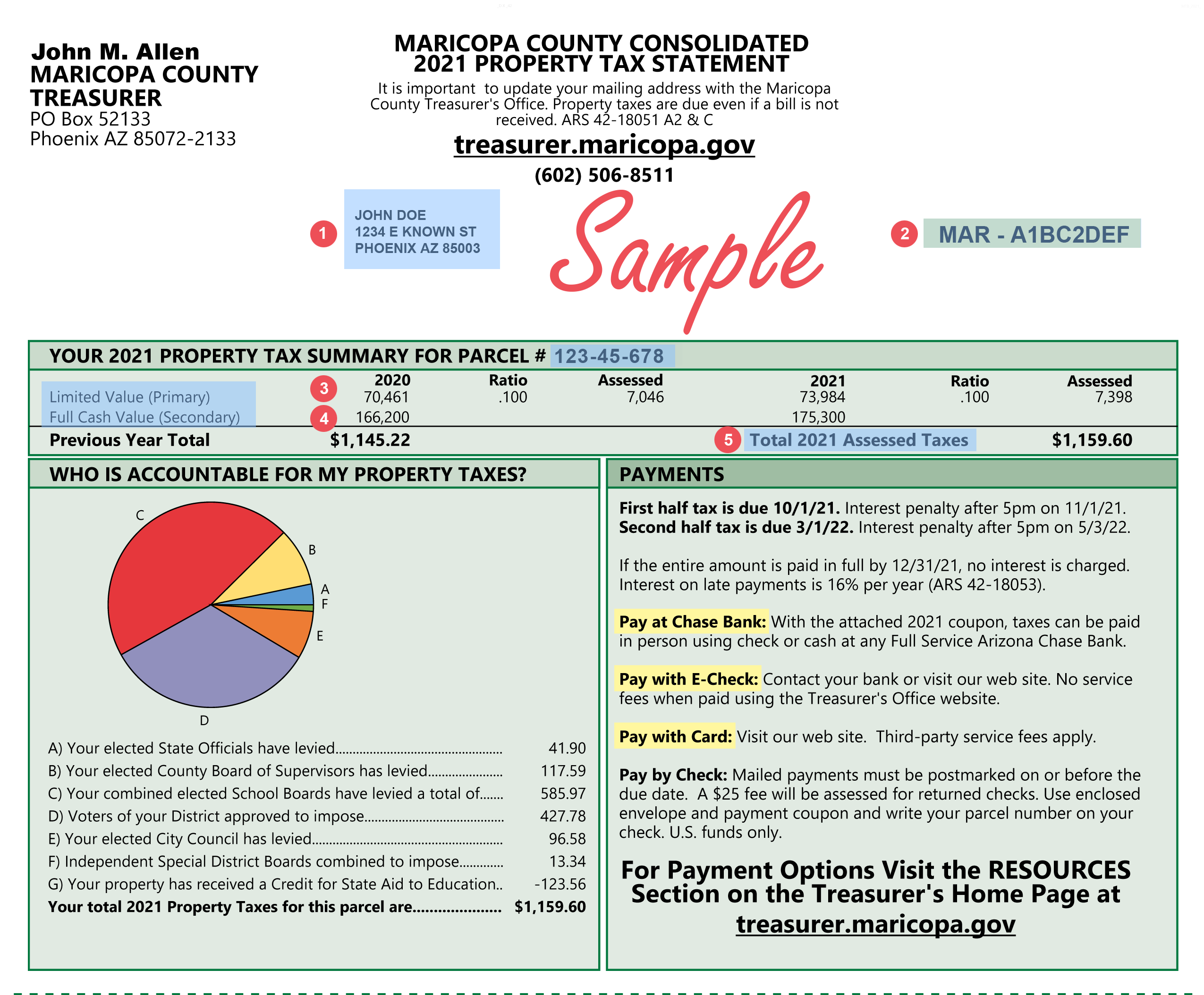

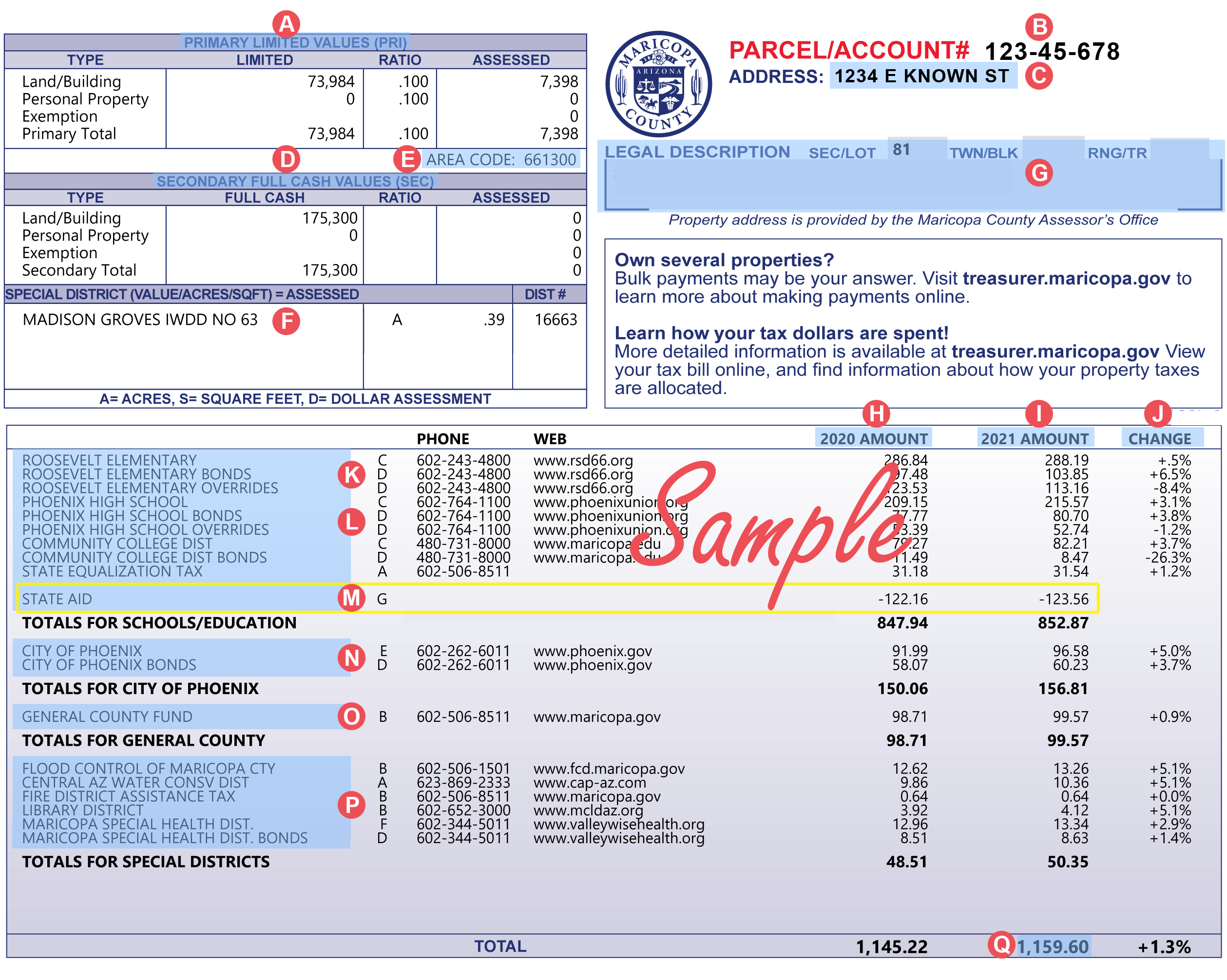

Maricopa County Treasurer S Office John M Allen Treasurer

Maricopa County Treasurer S Office John M Allen Treasurer

Tax Liens Tax Lien Foreclosures Arizona School Of Real Estate And Business

Irs Tax Attorney Tax Debt Advisors

Irs Tax Lien Problems Tax Debt Advisors

Maricopa County Treasurer S Office John M Allen Treasurer